Tax on account for companies – ordinary and voluntary

Tax on account for companies – ordinary and voluntary

Over the year, companies are required to observe three final due dates for payment of tax on account. Two of the due dates relate to the compulsory, ordinary tax on account, which is calculated by the Danish Customs and Tax Administration (SKAT), and the third due date concerns the voluntary payment of tax on account, where your company has some options:

- First instalment, ordinary tax on account: final due date is 20 March of the current financial year

- Second instalment, ordinary tax on account: final due date is 20 November of the current financial year

- Third instalment, voluntary tax on account: final due date is 1 February of the following financial year

You also have the option of paying voluntary tax on account on top of the ordinary tax on account in March and November. I will address this option in more detail below.

Ordinary tax on account

In 2017, ordinary tax on account constitutes an amount equal to half of your company’s average actual tax for the income years 2013, 2014 and 2015. This means 11% of your company’s average income for these years, 50% of which is payable in March and the other 50% in November.

If your income performance is expected to be weak in 2018, you can use E-tax for Businesses (TastSelv Erhverv) to request SKAT to reduce the rates. This option is open right up to the final due dates for the first and second instalments in March and November, respectively.

If your company participates in a joint taxation arrangement, the aggregate tax on account is payable by the administrative company.

Voluntary tax on account

If you assess that the ordinary tax payments on account are insufficient to cover the actual tax for the income year, you can choose to supplement the ordinary tax on account with voluntary payments. You are free to choose whether you prefer paying voluntary tax on account in both March and November or only in one of these months.

Besides, you can opt for the so-called third voluntary payment, which does not fall due until 1 February of the following year. This later due date, 1 February 2018, gives your company an opportunity to gain an accurate picture of your net profit for 2017 and, accordingly, to know the exact total amount of tax payable for the income year 2017. Since this calculation may be difficult to perform as early as November, it is an advantage for many businesses to opt for this third instalment, which is not due for payment until one month after the end of the financial year.

A voluntary payment must be created through E-tax for Businesses before your company transfers the money – otherwise, SKAT will return the amount.

Premium in connection with voluntary payment of tax on account

If you choose to make a voluntary payment of tax on account, you should keep in mind that if a voluntary payment is made in March, your tax account will be credited with a premium, whereas a premium will be charged on a voluntary payment in November and in February. For the income year 2017, the following premiums are applied:

- Payment in March: 0%

- Payment in November: 0%

- Payment in February: 0.7%

This means that if your company makes a payment of DKK 100,000 on or before 1 February 2018, an interest premium of DKK 700 will be charged. If your estimated tax underpayment amounts to DKK 100,000, you will therefore be required to pay DKK 100,700.

This interest premium is much lower, however, than the tax underpayment penalty you would have to pay in November. For the income year 2017, the underpayment penalty rate is 3.4%, and the penalty is non-deductible. If you pay underpaid tax on or before 1 February 2018, you will therefore save 2.7% (3.4-0.7) of your tax payment for the income year 2017.

Do you have sufficient liquidity?

It is my assessment that if your company has the necessary excess liquidity, then you should definitely consider paying the underpaid tax as an instalment on account in February and be “let off” with a tax underpayment penalty at the rate of 0.7%. In this fashion, you will avoid paying higher and non-deductible interest. Are you up-to-date with the non-current assets register?

Are you up-to-date with the non-current assets register?

The year is drawing to a close, which means that many businesses are about to perform year-end closing for the financial year 2017. In this connection, the non-current assets register has to be reviewed and reconciled to the general ledger.

As an accounting consultant, I have frequently experienced that important points were overlooked when the non-current assets register had to be updated. I have therefore listed some of the key items below:

1) Assets scrapped/sold

The non-current assets register must be reviewed to check whether it contains assets you no longer own. The assets may have been either sold or scrapped. If you have sold assets during the year, the selling price must be recorded in the non-current assets register and any loss or gain needs to be calculated.

Assets sold will typically be easy to identify in the bookkeeping records since a selling price will have been booked. If you have not updated your non-current assets register on an ongoing basis, the bookkeeping records will therefore help you find the selling price.

Furthermore, there may be assets that were scrapped during the year and where the selling price is therefore DKK 0. These assets should no longer appear in the non-current assets register either, and they must therefore be recorded as disposed of at a selling price of DKK 0. This is exactly the type of assets that can often be overlooked because many of them have also been written down to DKK 0 according to the non-current assets register, but the disposals need to be recorded all the same.

2) Scrap value/residual value

Scrap value is the assessed value of an asset at the end of its depreciation period. That means the approximated value at which an asset can be sold when the depreciation period has ended. Previously, the scrap value of the majority of assets was entered in the accounts at DKK 0, but today the scrap value needs to be assessed continuously for the individual assets. The scrap values of assets in the non-current assets register should therefore be reviewed and changed if they are no longer correct. This applies to the assets you acquired in 2017, but also to existing assets acquired pre-2017.

3) The “component approach”

If you have acquired any complex or large assets, the component approach must be applied to the asset in the non-current assets register. This means the asset will have to be split into separate components to ensure that the asset has more than one depreciation period. That may cause a significant difference in the annual amount of depreciation, and it is therefore important to identify the various components.

A popular example of an asset to be broken into components is the acquisition of a property. The asset consists of many parts, including windows, walls, floors, etc. All components have very different useful lives and therefore also have to be depreciated over different periods. If you are in doubt as to whether the component approach needs to be applied to an asset, please feel free to contact me or one of my colleagues. New Rates 2018

New Rates 2018

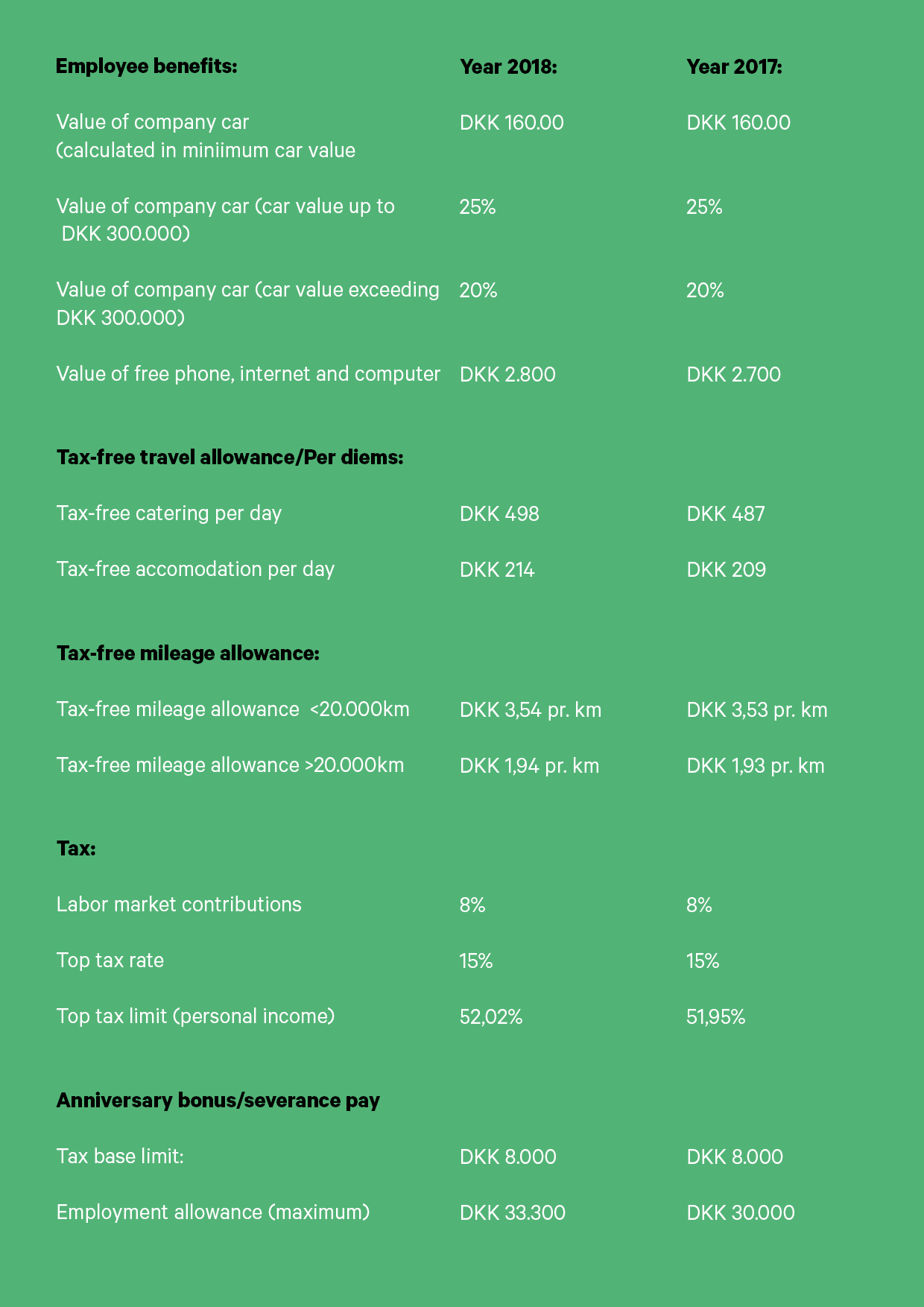

The Danish Tax Authorities have published new rates for year 2018 regarding employee benefits, tax-free benefits, etc.

Invoice requirements

Invoice requirements

When you start a business, you must be aware that there are some legal and formal requirements for the formation of a sales invoice.

Most accounting systems today have this feature built in, and we therefore strongly recommend that you use these systems, not only to develop the invoice, but also for bookkeeping.

The following are the requirements that the Danish tax authority describes on its website:

An invoice for trade within the EU should contain the same information as for domestic trade – that is, information about:

- Issue date (invoice date).

- Consecutive number, based on one or more series, which uniquely identifies the invoice.

- The seller's name, address and VAT number.

- The buyer's name and address.

- The delivery.

- The amount and nature of the goods supplied.

- The date on which the delivery of goods is made or completed or when a down payment should be made, but only if the date is fixed (for example, delivery date), and it is different from the invoice date.

- The VAT base, price per unit without VAT, and any discounts, refunds and

- rebates if they are not included in the price per unit.

If in a particular situation there is to be charged Danish VAT (for example, by sale to a non-registered business or private person), the following must also be added:

- The VAT rate (in Denmark, 25 percent).

- The VAT amount to be paid. If invoiced in a foreign currency - other than the Euro - the tax amount must be stated in Danish Kroner, or the conversion rate for the Danish Kroner must be stated in the invoice. The seller and buyer must therefore apply the same VAT amount in Danish Kroner.

When selling to a VAT registered business in another EU country (including tax-exempt companies, registered for goods purchased in other EU countries) do not specify the amount of VAT, but the company must pay VAT in another EU country. However, the invoice should provide further information on:

- Country code associated with a VAT number (DK + 8-digit CVR / SE number).

- The customer’s country code and VAT number.

- That VAT has not been charged. This information may be given in one of

- the following ways, at the seller’s discretion:

- Reference to the relevant provision of the VAT Act, for example, exempted under VAT Act §34, paragraph 1.

- Reference to the relevant provision of the VAT System Directive, such as article 138.

- Or by another distinct relevant endorsement, for example, "zero- rated", free of VAT" or the like.

When selling to a non-registered company in another EU country, the invoice must show the calculated Danish VAT. This does not apply if you are registered for sales in the recipient country. In that case, you must calculate the VAT using the recipient country's VAT rate.